When a life-saving drug disappears from shelves, it’s not just a logistics problem-it’s a public health emergency. In 2025, over 300 essential medicines in the U.S. faced shortages, from antibiotics to insulin and chemotherapy agents. The root cause? Fragile global supply chains that were built for efficiency, not survival. The era of relying on single-source suppliers across continents is over. What’s needed now is a new kind of system-one designed to keep working when the world breaks down. Building pharmaceutical supply chain resilience isn’t optional anymore. It’s the difference between life and death for millions.

Why Drug Shortages Keep Happening

Most people assume drug shortages are random. They’re not. They’re predictable. And they’re rooted in a few key weaknesses.

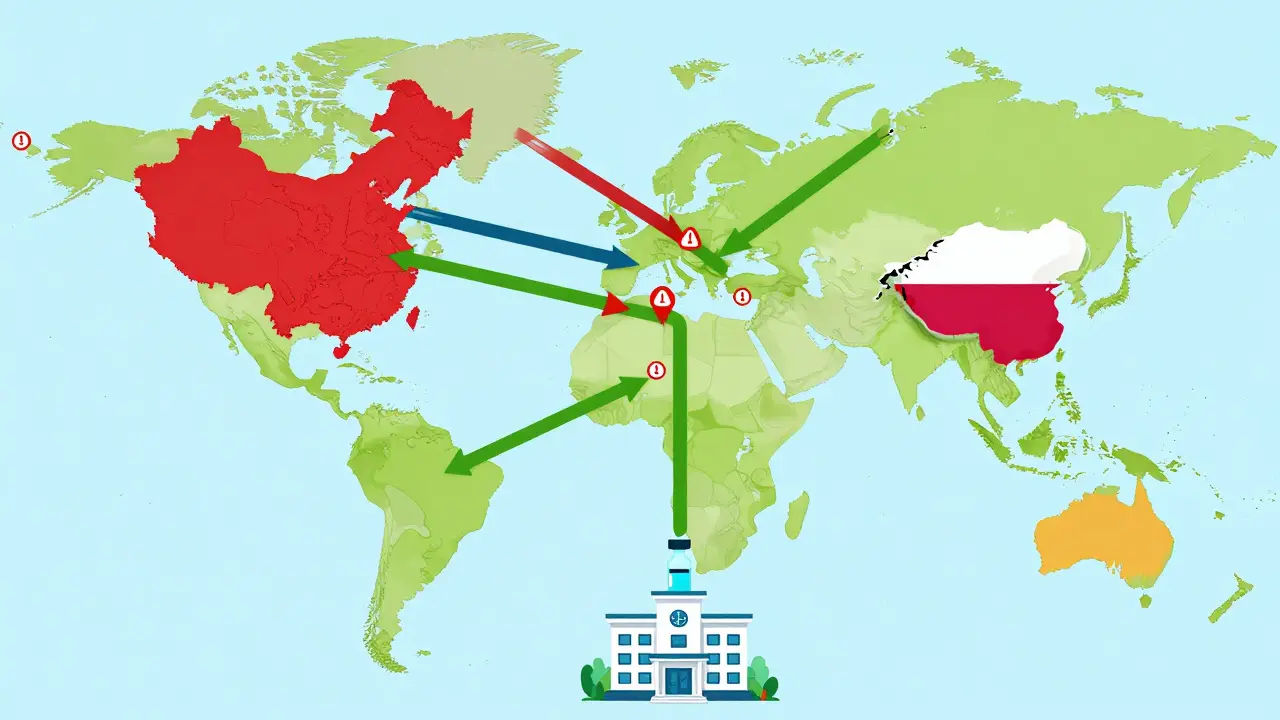

Over 80% of the active ingredients in U.S. medications come from abroad. China alone produces 45% of these critical components, called active pharmaceutical ingredients (APIs). India adds another 23%. That means a flood in a factory outside Mumbai, a trade ban from Beijing, or even a labor strike in Shanghai can ripple across hospitals in Ohio or Sydney. These aren’t hypothetical risks. In 2023, a single factory shutdown in China caused a 6-month shortage of generic antibiotics used in over 10 million U.S. patients annually.

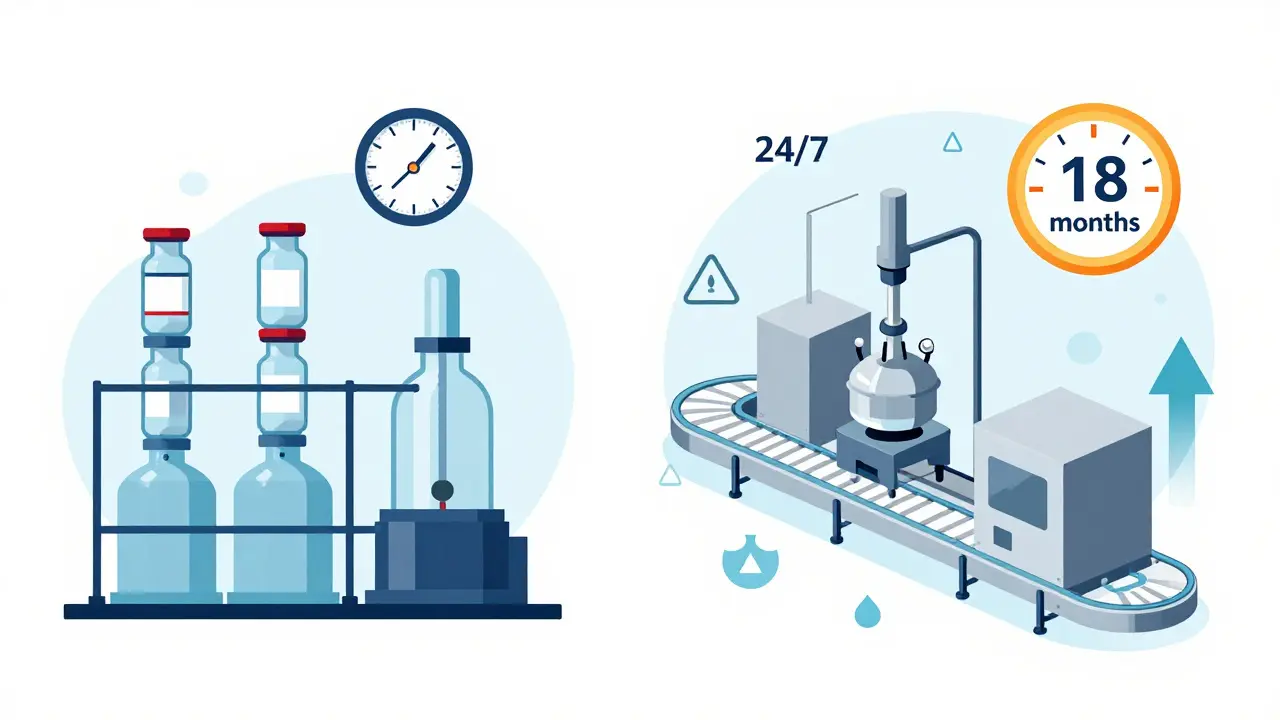

Even when production happens domestically, it’s often done in outdated batch manufacturing systems. These are slow, wasteful, and hard to scale. One batch can take weeks to produce. If something goes wrong, the whole batch is lost. Meanwhile, global competitors are switching to continuous manufacturing-systems that run 24/7, use 30% less space, and cut waste by up to 20%. But only 12 such facilities have been approved by the FDA as of mid-2025, compared to over 10,000 traditional ones.

The result? A system that’s brittle. One disruption, and entire categories of medicine vanish. Patients delay treatments. Doctors prescribe less effective alternatives. Emergency rooms ration doses. And the cost? Large pharmaceutical companies lose an average of $14.7 million per major disruption. But the real cost is measured in lives.

The Four Pillars of a Resilient Supply Chain

Resilience isn’t about one fix. It’s about building multiple layers of protection. Leading companies and governments are now focusing on four core areas.

1. Diversify Your Sources

Relying on one country for 70% of your APIs is like keeping all your money in one bank. The smart move? Dual-sourcing. Top performers now require at least two suppliers for every critical ingredient-one in Asia, one in North America or Europe. Some are even adding a third in Latin America or Eastern Europe. This isn’t just about geography. It’s about regulatory diversity too. A supplier in India may be cheaper, but if the FDA flags their facility, you need a backup that’s already approved.

2. Build Buffer Stock

Lean inventory is great for quarterly earnings. It’s terrible during a crisis. Resilient companies now keep 60 to 90 days of inventory for essential medicines-especially sterile injectables, antibiotics, and oncology drugs. The U.S. government is taking this further. The 2025 Strategic Active Pharmaceutical Ingredients Reserve aims to stockpile 90-day supplies of 150 critical drugs by 2027. This isn’t hoarding. It’s insurance.

3. Invest in Modern Manufacturing

Continuous manufacturing is the game-changer. Instead of making drugs in batches, these systems produce them in a steady flow-like a factory for soda. They’re faster, cheaper to run, and easier to scale. A single containerized continuous manufacturing unit can go from design to production in 12 months. Traditional plants take 3 to 5 years. The catch? They cost $50 million to $150 million to build. But for companies that have made the switch, yield rates improved by 18-22%, and quality errors dropped by 25-30%. The FDA is speeding up approvals for these systems-cutting review time from 3 years to under 18 months.

4. Use Real-Time Data

Most companies still track inventory with spreadsheets and phone calls. Resilient ones use AI-powered platforms that monitor everything: supplier performance, weather in manufacturing zones, port delays, even political unrest. One company reduced its vulnerability detection time from 45 days to just 7 by integrating supplier data into a single dashboard. Predictive tools now forecast disruptions with 85-90% accuracy up to 90 days in advance. That’s enough time to reroute shipments, switch suppliers, or activate buffer stock.

What Governments Are Doing (And What’s Missing)

The U.S. government has woken up. In 2025, it launched a $1.2 billion program to rebuild domestic API production, backed by the CHIPS and Science Act. An additional $800 million was proposed to expand manufacturing capacity. The new Strategic Reserve is a major step. But money alone won’t fix this.

The problem? Regulations haven’t kept pace. The FDA still treats every new manufacturing method like a brand-new drug. It takes years to get approval. Meanwhile, companies are stuck choosing between slow, safe methods or risky, fast ones. The industry needs regulatory sandboxes-safe zones where new tech can be tested without full-scale approval.

Another blind spot: workforce. By 2027, the U.S. will be short 250,000 skilled workers in pharmaceutical manufacturing. No amount of automation fixes that. Training programs, partnerships with community colleges, and immigration reforms for skilled technicians are just as critical as new factories.

Costs, ROI, and the Real Trade-Offs

Yes, building resilience costs more. Companies now spend 5-10% of their supply chain budget on resilience. That adds 8-12% to the cost of goods sold. But here’s what most people miss: the cost of doing nothing is higher.

Companies with strong resilience strategies saw 23% higher operational continuity during disruptions. That translates to $14.7 million saved per major event. And the ROI? Leading firms see a 1.8x return on their resilience investments within three years-not just from avoided losses, but from faster market access during crises. Hospitals and insurers pay more for reliable suppliers. Patients trust brands that don’t run out.

But there’s a danger in overcorrecting. Some politicians push for 100% domestic production. That’s unrealistic-and risky. If you make everything in one country, you create a new single point of failure. A wildfire in Arizona or a power grid failure in Texas could shut down half the nation’s medicine supply. The goal isn’t to bring everything home. It’s to have multiple, balanced, and diversified sources.

What Works in Practice

Look at how one mid-sized drugmaker in Pennsylvania fixed its insulin shortage. They had one supplier in India. When a cyclone hit the port, shipments stopped for 11 weeks. Their solution? They found a second supplier in Germany, already FDA-approved. They bought a 60-day buffer stock. They invested in a small continuous manufacturing unit for backup production. Within 18 months, they went from being vulnerable to being the only local supplier with consistent inventory. Their market share grew by 19%.

Another example: a major hospital network in California used AI to predict a shortage of a critical antibiotic. The system flagged rising demand in the Southwest and a delay in a Chinese port. They shifted orders to a backup supplier in Mexico and activated their buffer stock. No patient was turned away. No emergency room was forced to use a less effective drug.

These aren’t big pharma stories. They’re survival stories. And they’re repeatable.

The Road Ahead: What’s Next?

By 2027, 45-50% of new pharmaceutical manufacturing will use continuous systems. By 2030, 65-70% of U.S. drug supply will come from regional networks-not just China or the U.S., but also Mexico, Canada, Poland, and Singapore. Blockchain will cut counterfeit drugs by 70%. AI will predict shortages before they happen.

But none of this happens without action. For manufacturers: start mapping your supply chain down to Tier 5 suppliers. Don’t just know your direct vendor-know who their vendor is. For regulators: simplify approvals for new tech. For governments: fund workforce training, not just factories. For hospitals and pharmacies: demand transparency. Ask suppliers: Where is this made? Do you have a backup? Do you have inventory?

Resilience isn’t a project. It’s a mindset. It’s choosing reliability over savings. It’s accepting that a little more cost today prevents chaos tomorrow. The next drug shortage isn’t a matter of if-it’s when. The question is: will your supply chain be ready?

What causes most pharmaceutical supply chain disruptions?

The top causes are geopolitical events (trade bans, conflicts), natural disasters affecting manufacturing regions, regulatory shutdowns of overseas facilities, labor strikes, and port delays. Over 60% of disruptions trace back to suppliers in China or India, where most active pharmaceutical ingredients (APIs) are made.

How much inventory should a hospital keep for critical drugs?

For essential medicines like antibiotics, insulin, and chemotherapy agents, hospitals should maintain 60 to 90 days of inventory. This is the standard recommended by the U.S. Department of Health and Human Services and adopted by leading health systems to prevent patient care disruptions during supply chain shocks.

Is onshoring drug manufacturing the best solution?

Not alone. Building domestic capacity is important, but trying to make 100% of drugs in the U.S. would raise costs by 20-30% and create new risks-like relying on one region for everything. The best approach is a balanced mix: strategic domestic production for critical drugs, plus diversified international sourcing and regional manufacturing hubs in Canada, Mexico, and Europe.

What’s the difference between batch and continuous manufacturing?

Batch manufacturing makes drugs in separate lots-each one taking weeks and prone to failure. Continuous manufacturing runs 24/7 in a single, connected system. It’s faster, uses 30-40% less space, cuts energy use by 20-25%, and reduces waste by 15-20%. It’s also easier to scale. The FDA has approved only 12 continuous facilities as of mid-2025, compared to over 10,000 batch plants.

Can AI really predict drug shortages?

Yes. Leading companies use AI tools that analyze global data-weather patterns, port congestion, supplier financial health, and even social unrest-to predict disruptions with 85-90% accuracy up to 90 days in advance. Early adopters have cut response time by 50% and reduced shortage events by 40%.

What’s the biggest barrier to building resilient supply chains?

Organizational silos. Many companies have separate teams for procurement, manufacturing, regulatory affairs, and logistics-and they don’t share data. The most successful resilience efforts happen when these teams work together with shared goals, real-time data, and executive sponsorship. Companies with cross-functional teams see 3.2x higher success rates in implementation.

What You Can Do Now

If you’re in healthcare, pharmacy, or policy, here’s your checklist:

- Ask your suppliers: Where is this made? Do you have a second source?

- Track your inventory for top 20 critical drugs. Are you below 60 days?

- Push for real-time supply chain visibility tools-don’t wait for spreadsheets.

- Support policies that fund workforce training and modern manufacturing.

- Don’t assume big pharma has it covered. Small suppliers are often the first to fail.

Resilience isn’t about perfection. It’s about preparation. And the time to act is now-before the next shortage hits.

Post A Comment